To understand international investment appraisal, first, we need to define what simple investment appraisal is? And how it is important in assessing the viability and profitability of a business venture. Investment appraisal, according to experts and academics, is the assessment or analysis of a business project, its profitability, affordability and sustainability over the life of an asset and strategic risks.

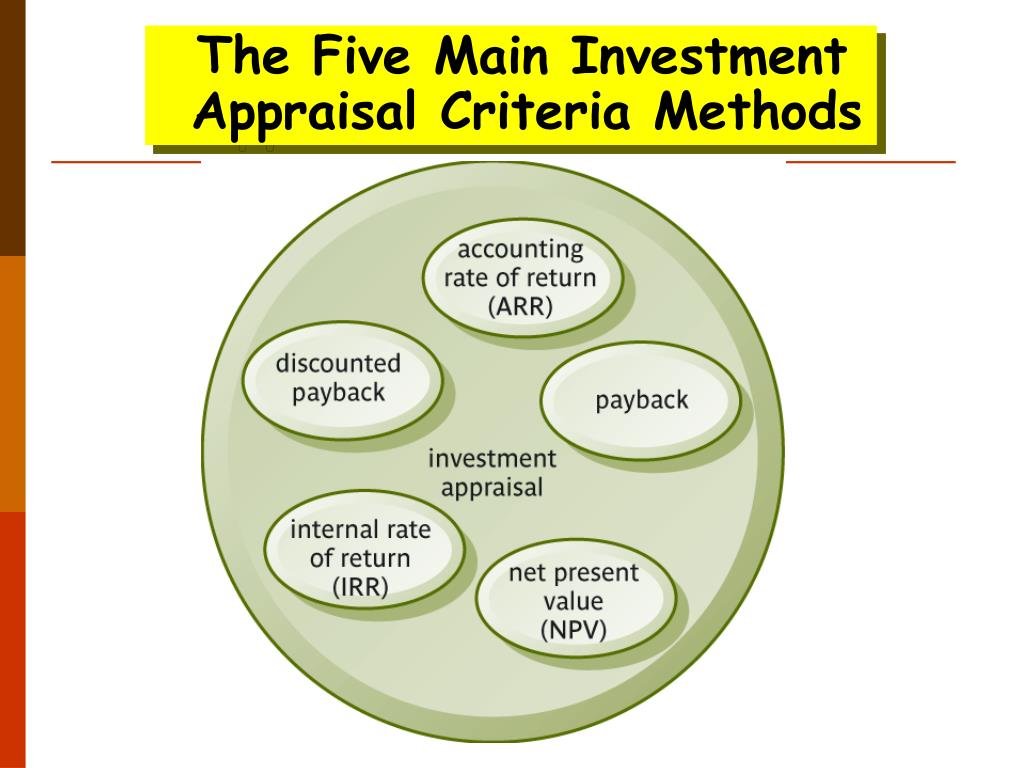

It is used to evaluate the capital investment or assess its worth. The methods of investment appraisal are payback, accounting rate of return and the discounted cash flow methods of net present value (NPV) and internal rate of return (IRR).

Although the same concept and techniques are used for the international investment appraisal, there are some differences between an international investment appraisal and the normal appraisal.

International investment appraisal could be a very high-risk investment, and one might be required to establish a special cost of capital for evaluating the project, possibly using the capital asset pricing model (CAPM) and a beta factor for the project.

Most of the cash flows for the foreign investment is done in the foreign currency, mostly in the US dollar, although some cash flows might be in the currency of the parent company or host country.

In the case of a developing country, the risks for an international investment such as inflation are very high. If such cases, the estimated cash flows should be calculated on the basis of the expected inflation rates. The cash flows including an allowance for inflation should be discounted at the money cost of capital.

However, in the case of a developed country, there might be restrictions on the number of payments that can be made from the foreign country, due to strict exchange control regimes. This means that the cash profits from the project might not be payable immediately in full as dividends to the investing company.

The method used for evaluating the net present value of the overseas project is to discount the cash flows in the foreign currency using a foreign rate appropriate to that currency, and then convert the resulting NPV to local currency at the spot exchange rate or convert the project cash flows into rupees and then discount at a rupee discount rate. In conditions of capital market perfection, the two methods would result in the same rupee NPV. According to the Modigliani and Miller theory, the country risk premium is taken into account in the calculation of CAPM.

For a number of reasons the cash flows in the company’s domestic currency will be different from that of the currency of the foreign country:

–There may be some costs incurred in the company’s domestic currency and outside the country where the investment is made. For example, the company’s head office may incur costs in its own currency to establish the project in a foreign country.

— There may be restrictions on dividend payments and other cash transfers out of the country where the investment is made.

— The amount paid as dividends from the foreign country will also vary over time with changes in the foreign exchange rate between the currency of the investment country and the currency of the investing company.

While deciding whether to go ahead with the project or not if the NPV of the project is positive accept the project and if the NPV of the project is negative reject it.

Seher Ifzal is a student of MS, Shaheed Zulfikar Ali Bhutto Institute of Science and Technology (SZABIST) Islamabad campus.

The High Asia Herald is a member of High Asia Media Group — a window to High Asia and Central Asia